Fraud Blocker: The Best Click Fraud Protection Software – 2024

Fraud Blocker is a form of self-insurance that companies can use to fend off online dangers and preserve their reputation. We go through what you need to know when it comes time as well as key features, learning curve, and integrations in this ultimate fraud blocker buyer guide. After you read this post, you will have the knowledge to help write regulations that aid in securing your business against fraud.

Overview and Key Features

Learn why a dependable fraud prevention solution is the need of an hour for your business to protect against fraudulent activities. Fraud Blocker is designed to catch these actions and keep them from disrupting your operations, so you can make sure your business stays up and running safely.

Fraud Blocker Features:

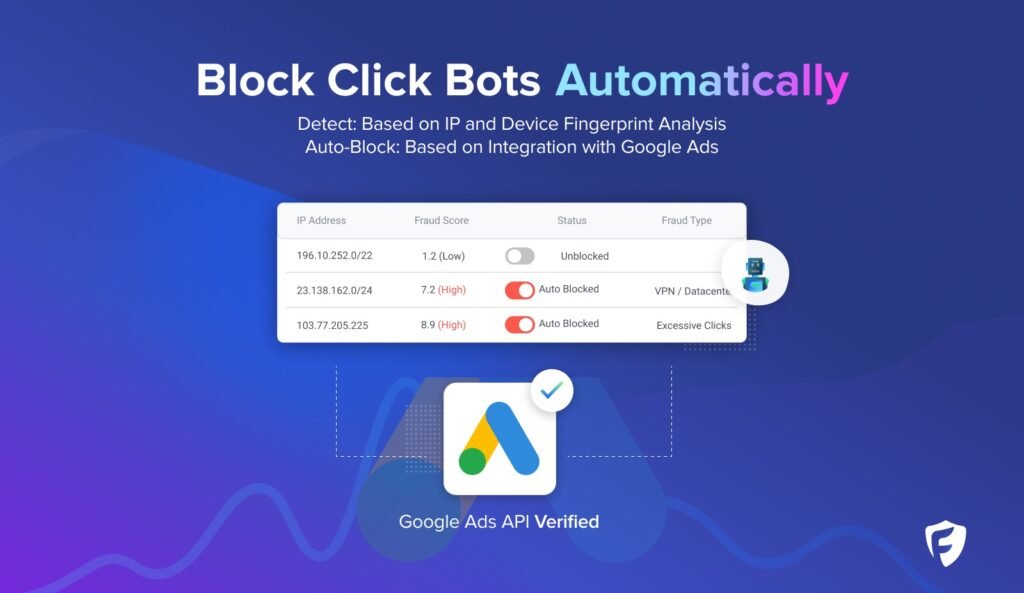

Real time monitoring: the Fraud Blocker system screen all transactions as they occur and alerts you of any possible fraudulent activities at that very moment. In turn, this decreases the chance of financial impact and operational downtime preemptively.

With advanced algorithms: Any good fraud blocker is based on its algorithm. These algorithms are made to learn patterns and identify fraudulent activities with accuracy. As a better algorithm would detect less false positives and thus lead to more accurate fraud detection.

Flexible and Personalized Rules: No 2 counterparts are the same, each brand is in touch with different fraud threats. Fraud Blocker is fully configurable, which means you can set up detection rules on what you would like to accept or block based on your own business model and risk appetite. This makes for a much more secure overall solution.

Better Reporting: Continuous security means understanding when and how you are open to fraud. Comes with detailed reports on what kinds of fraud attempted against you, and how strong your security is.

There is an English saying that very fancy of a thing you have to have the ease of use as well. Intuitive interface allows you to easily change settings or respond to threats with little training required; Fraud Blocker itself is simple and operational.

Choosing a fraud blocker with all of these essential features, not only protects your income but also ensures that you develop the trust that consumers have started to demand.

Ease of Use

Nonetheless, to any business owner, convenience is the most important when selecting fraud protection software. Having a complex system can slow down the speed of operations as well as time required to respond to threats. Fraud Blocker is designed to be simple so your team can move quickly and effectively.

Ease of Use: The best fraud blockers have a simple interface that makes it easy for users to find settings and access functionality. Editing detection rules, reviewing flagged transactions and generating reports should easy to do in the most efficient manner.

Easy to Set Up and Integrate: The top fraud prevention tools are available within your own system. You can set Fraud Blocker within a matter of minutes and have it integrated with e-commerce platforms, payment gateways, CRM system with few clicks only This means that you will be able to immediately implement the system and not have any business interruptions.

Persona-lization of Dashboards – Set up dashboards to show what you want, i.e., real-time alerts, and KPIs. This ease of reach interface, that can be customised to have the most important data in this screen reduces complexity and lowers cognitive load for the user.

Training and Support – Comprehensive training and support resources are critical for getting the most out of your fraud prevention tool. Fraud Blocker provides tutorials, webinars and documentation so that your team is well-trained to manage the system. Responsive customer support also means quick solutions to any problems.

After all, usability is as important as tech capability when selecting a fraud blocker. Takes it right off of our plate to set up, integrate and operate so that the team can focus on running my business as securely as possible.

Detection Accuracy

The effectiveness of a fraud prevention tool is measured by how accurately it can spot fraudulent activities. Fraud Blocker provides enhanced technology which ensures continuous accurate detection of fraudulent transactions at early stages without disturbing the legitimate transactions.

Accurate Via Advanced Algorithms: Fraud Blocker performs real-time analysis on high-volume data streams & uses cutting edge algorithms to flag suspicious patterns most likely to be fraud. The system will be capable of distinguishing real transactions from the fraudulent ones because it is programmed with sturdy algorithms.

AI & ML integration — many online fraud blockers now offer AI & machine learning to increase the accuracy of detection with time. The longer you have Fraud Blocker enabled on your store, the better it will become at detecting and blocking new kinds of fraud.

Real-time threat monitoring: fraud blocker assesses the risk of each transaction on a real-time basis, providing immediate response to any fraudulent activities. This approach enables in real-time processing that helps to stop fraud before it reaches your doors.

Second, Reduce False Positives: Of course fraud detection is important but more important is to reduce False Positives. The GlobalGateway Fraud Blocker also minimizes false positives by discerning true fraudulent transactions from legitimate ones to provide a seamless customer experience.

If no, the detection rules are customizable: Different businesses also encounter different kinds of fraud. It has Custom detection rules to block fraudulent user input from your specific cases using Fraud Blocker. This prevents over-triggering alerts for false positives and under-firing errors with more accurate fraud detection.

Detection Accuracy — Finally, what this all comes down to is one criteria above all else: detection accuracy. It is using our most advanced algorithms, AI, real-time threat analysis and customizable rules to help detect fraud in a way that minimizes the amount of legitimate transactions that will be stopped.

Conclusion

With Fraud Blocker, your company will be safe from cyber attacks. Anilopez — With real-time monitoring, sophisticated algorithms, custom rules and user-friendly interfaces, it has all you need for securing your revenue and reputation. Choosing therefore a fraud prevention tool that can handle all of this means your business is prepared for the coming year and can keep growling regardless of any changes in threats.

Fraud Blockers Can Be Customized and Flexible

The Flexibility of a Fraud Blocker is One of the Biggest Benefits Each business has to deal with fraud in a different way, and using the same method for everyone can do more harm than good. A robust and a scalable fraud prevention solution: You do not want negative impacts on your business performance but still, you require strong measures to be in place that automatically catches any fraudulent transaction happening on your website.

Custom Fraud Detection Configurations: Here, you can configure the fraud detection settings to exactly meet your requirements. This flexibility allows to never cry wolf and remains unobtrusive while still secure.

Tailored Detection Rules

With flexible fraud detection rules, you design the criteria for your business based on its risk factors. Create custom rules with Fraud Blocker, concentrate on particular transaction types (e.g., mobile transactions, card-not-present transactions or geographic-based behaviors). Doing so provides the level of fine-grained customization that makes your fraud detection accurate, minimizes false positives and allows the system to adapt to how fraud is perpetrated on your business.

Select different Levels of Sensitivity by the User

Each business has its own set limit of risk it is willing to take on. Adaptive Detection Thresholds Provide the flexibility you need to adjust sensitivity based on your risk appetite. Whether you want to flag even tiny differences, or only alert on high risk deviations, Fraud Block makes it to provide the perfect combination of security and convenience.

Interbusiness model scalability

No matter what, a good fraud blocker should be able to scale with your business whether you are a small start-up or large enterprise. The fraud prevention system boasted by your payment gateway should scale as you see exponential growth in your business, process more transactions without compromising on the front of performance or accuracy. Fraud Blocker Scale: Built to Grow with Your Business As your business grows and industry dynamics change, Fraud Blocker is built to be scalable.

Integration with Existing Systems

It needs to work well with your systems A flexible fraud blocker. Adjust Fraud Blocker to work with your e-commerce platform including payment gateways and CRM systems – use can be so seamless that managing fraud prevention actually fits into your day-to-day operations instead of disrupting them.

User Role Management

User role management is customised and access to the fraud prevention system can be provided based on user’s roles. This functionality helps to optimize access by ensuring that the correct individuals have the required fraud detection management tools, while helping to prevent unauthorized entry.

To sum up, with the exception of limiting fraud blocker should be individually tailored and adaptable. A flexible fraud prevention tool that allows you to adapt rules, sensitivity settings and integrate seamlessly into your environment.

Scalability in Fraud Blockers

Fraud Prevention for Improve Online Business Fraud mitigation including lower percent fraud As an online business scales up, so too does the difficulty in preventing fraud. To prevent fast-growing transaction volumes from affecting the fraud blocker´s performance and reliability, provide a scalable solution.

Higher Number of Transactions

It should enable you to process an increasing number of transactions as your company scales which is a sure sign of a fraud block that can scale. The system should be capable of handling the load, irrespective of whether you process 100 transactions or a thousand or even tens of thousands everyday, and at the same time being able to identify anomalies as efficiently as possible. That way, as transaction volume grows, your business is being protected against potential fraud.

Flexibility to Scale

A recoordex fraud blocker should scale with your business as it grows, without forcing you to switch solutions when you expand into new markets, launch new products or have seasonal spikes. The fraud blocker can scale up and down based on your demand hence you do not incur massive redevelopment or even having more staff. To schedule a consultation with one of our experts on how to stop Ad Fraud, Contact us at fraudblocker.addAction Required!

Support for Multi-Channel Operations

Because businesses are increasingly becoming omnichannel — with online stores, mobile apps and in-store transactions coming together on a single platform — fraud blockers need to offer this same degree of protection on every channel possible. Multi-channel / channel agnostic ensures that fraud protection is uniform across all transaction points without losing its scale of high fraud detection.

Performance Under Pressure

For example, when it is a high-volume time of year — think holiday sales or promotional, your fraud blocker must be frictionless. The original fraud blocker also does not induce delay because it was well designed to withstand these peaks, and continue with the correct detection of frauds over real time without prejudice in customer experience.

Cost-Effective Growth

However, scalability should come at a cost! The platform also provides a dynamic pricing model that can serve to match various stages of business without paying for unused features or capacity as you grow. Reduced costs: overall, the cost of inline fraud prevention is much more economical, which allows companies to prevent abuse while staying profitable.

Given all this, scalability becomes key for any fraud blocker. As more transactions enter the system, Operator Connect is not only helping to deliver them more easily, but within a more secure framework as well — all with automatic white/black listing and easy-to-configure fraud rules (you can check out what this looks like in our webinar here). Frauds that usually take minutes to detect are solved instantly. And as revenues grow, so do the fraud detection capabilities. Fraud Blocker will remain interactive regardless of number of transactions in real time (i.e., “+10k ops per second”) using simple billing plans based on your volume. Simply put: it´s everything you need to handle growing business.

Fraud blockers: price and plans

Consumers must consider pricing when it comes to choosing a fraud blocker. The best solution will have strong fraud protection yet will be cost effective and worth the price paid.

Flexible Pricing Models

Our different pricing models allow small and large businesses to take advantage of Fraud Blocker. Examples of pricing models can be from subscription based for which you would have a monthly / yearly recurring charge to usage based where costs are calculated, based on the number of transactions or fraud detection request made. This flexibility helps you to be cost effective with exactly what you need.

Tiered Plans

They have a layered system in which businesses can choose the plan that best fits their requirements when it comes to Fraud Blocker. Lower end plans will cover your basics like real time monitoring and simple reporting — this means AI-based detection and in depth analytics are reserved for the more premium plans. With multiple tiers of coverage, companies can easily choose a plan to begin with and upgrade as the need arises.

Customizable Plans

Certain businesses will need a more bespoke service. Customizable Plans — Fraud Blocker provides you the ease of choosing what features or services you require so that your fraud prevention system shapes up according to your operational needs

Free Trials and Demos

Most fraud blockers have free trials or demos, such as Fraud Blocker. This allows businesses to determine how the fraud blocker fits with their existing systems and works in real-world use cases.

Value for Money

However you would like to be able to evaluate the value for money of a fraud blocker you choose. Although an upgrade to a higher-tier of the price plan may cost more money, it is also protecting you from major financial damage due to fraud. Well, an evergreen concern is the fact that fraud can cost organizations thousands of dollars a month (or more) — so it’s essential to work with a fraud blocker that strikes the right balance between cost and capability in order for your investment in fraud prevention to pay off long-term.

Wrap-Up When Deciding On A Fraud Blocker, You Are Choosing Your Pricing & Plans Fraud Blocker offers solutions suitable for every e-commerce vendor whether they are small businesses working on a low budget or have got features to maintain the middle-sized business sites as well.

Support and Service as of Fraud Blockers

One of the most important parts of a successful fraud prevention solution is good customer support. Now the best fraud blockers give you super advanced tools but the poor support to actually use them effectively.

Availability of Support

Availability is among the basic factors of customer service. The service is provided 24/7 by Fraud Blocker, so help is always around if you need it – no matter where in the world or what time of day (or night) an emergency occurs. It is essential for potential fraud cases that require quick actions.

Multiple Support Channels

Fraud Blocker offers support via phone, email, live chat, and an online help center. This offers businesses a selection of options to receive the help they desire, from speaking with a representative directly, submitting an inquiry or viewing online resources.

Expertise and Responsiveness

Apart from availability, the also the quality of customer support is critical. The support team at Fraud Blocker is one of the best I have encountered and will answer all your questions, no matter how simple or complex they may be. This knowledge shortens the downtime and also maintains your fraud prevention system running.

You have to be tr ained first and on boarded.

In addition, we provide a tailored onboarding process including tutorials, webinars, and dedicated training sessions with Fraud Blocker. Sending your team to learn resources that allow them to quickly master how the fraud blocker works helps you leverage more from the tool on Day 1.

Ongoing Support and Updates

We know that fraud prevention is constantly changing, and Fraud Blocker is constantly working on enhancements and updating the system to provide you with ongoing compatibility with what is available in the market. This regular improvement means that what is a robust fraud blocker continues to be so and is able to meet new forms of advanced threats.

Feedback From Customers and the Community

It is a community where users can provide feedback, share tips and make suggestions. The concern is that providers who continue shying away from direct user engagement and user feedback will be less likely to implement upgrades for the betterment of all users.

Finally we have completed with one of the biggest aspect for fraud prevention; which is just simple customer support. And finally, Fraud Blocker is available around the clock with multiple support channels, providing expert assistance for any time a business may need their fraud prevention solution.

Integration with Other Tools

If you want your. business to succeed in the highly digital world of today, then, you need countless software solutions. Any type of fraud blocker should seamlessly operate with these systems to improve fraud detection and prevention without producing more work.

E-Commerce Platforms it Works With:

Integration is important in E-commerce A fraud blocker is only useful if it can be setup on popular platforms like Shopify, WooCommerce, or Magento. Enabling fraud detection from inside your online store allows you to easily avoid fake transactions through an embeddable solution, no plugins or convoluted solutions required. It is because this integration provides security and the systems work in real-time, that too with immediate customer responses fraud prevention system becomes more effective.

Payment Gateway Integration:

The following, critical area for the deployment of a fraud blocker is payment gateways. For seamless flexibilityIt should have direct integration to majors like PayPal, Stripe or Authorize — your fraud blocker. net. It thus can keep an eye on transactions as they happen and catch attempted fraud earlier, before it becomes expensive chargebacks. FraudDublin describes two secure payment processes that are essential for financial safety and avoiding vanishing funds.

That includes seamless CRM & Customer Data management integration.

Connecting your fraud blocker to Customer Relationship Management (CRM) tools like Salesforce, or HubSpot can help prevent fraud in a holistic manner. When customer data is combined with transaction monitoring, it allows financial institutions to build a better customer profile and at the same time detect unusual patterns, as well as flag potential fraud at an early stage. You can further tailor fraud attempt responses by segregating potentially risky customers upfront to be fast-tracked for review, which should speed up the overall reviews.

Abstracted API and Third-Party Integrations

A strong fraud blocker will have rich API support to help you integrate third-party tools and solutions. That means more efficient automation of fraud detection workflows and, ultimately, an overall fraud prevention strategy. This ensures a unified front through seamless integrations with our APIs for analytics tools, as well as custom apps for managing fraud by any of your specific requirements.

A central Dashboard and Reporting system:

Nowadays we need a centralized dashboard to be able to manage all our integrations in order to prevent fraud. A single centralized dashboard to get a view and manage all the integrations, monitor real-time data, and take quick decisions. It also provides reporting, where it combines data across every channel to give you a holistic picture of what you are doing on the front line to keep fraud at bay.

Scalability & Future-Proofing

Your fraud blocker must scale with the growth of your business, so you can deploy it and integrate smoothly with any new tool to adopt later. Thus, your fraud prevention system remains up-to-date and strong enough to shield your evolving business.

CEO FraudBlocker must be able to integrate easily with e-commerce platforms, payment gateways, CRM systems and other third-party applications. It provides whole fraud prevention along with consistent working throughout the business.

Security and Compliance

Fraud prevention security and compliance are the most important. Preventing Fraud while Protecting Your Data and Meeting Compliance Fraud detection fraud prevention is one of the primary concerns for businesses, especially if you operate in industries that are prone to fraud.

Data Security:

What is a Fraud Blocker, and what role do fraud blockers play in securing your data? In turn, this necessitates high-end encryption protocols to secure confidential customer data such as payment and identity information. Your fraud blocker should have the highest level of encryption means for data so as to avoid data breaching and cyber-attacks.

Support for the Standards of the Market

Fraud blocker also must be compliant with the industry standards industries, A good example is that businesses dealing with payment card information have to be Payment Card Industry Data Security Standard (PCI DSS) compliant. Staying in the confines of these regulations a fraud blocker acts as a necessary part of your compliance strategy, keeping you on the right side of fines and penalties while still protecting customer information.

Security Focused Audits and Updates

Regular security audits and updates: For your fraud blocker to be successful, it needs to be regularly audited. Routine system updates are meant to cover patches for vulnerabilities as they get discovered, and audits help spot potential weaknesses before they materialize into significant threats. Updating your fraud prevention tools will not only keep you safe but also ensure the integrity of the systems involved.

EDAP enables role-based access control (RBAC) allowing the levels of privilege for each user to be controlled using a security model that gives only the right people the right level of access.

RBAC is key security function that restricts the access to valuable data according to user ownership. This serve to decrease the risk of valuable data and functionality being breached, accidentally or maliciously; internal fraud is blocked as only permitted personnel have access.

Compliance Reporting:

A good fraud blocker will have tooling for compliance reporting—meaning you can generate reports which prove you´re sticking to the rules. For audit information, the only thing available are these reports which are essential for maintaining compliance with your legal obligations at a minimum amount of work and resources spent on audits or internal/external verification.

Response and Recovery:

There are also methods involved in the hand-off, but all of them fail; there can be breaches. A good fraud blocker will need an efficient incident response and recovery plan. I.e.: quick detection, precise logging and rapid recovery tools which allow us to limit the effects of any security issue.

A good fraud blocker that will not result in your business being classified as high risk by the authorities is one that gives you both; if in doubt, at least confirm from friends, and to avoid falling for such tricks subscribe to our newsletter. Your operations and the trust your customers have in you are both protected through consistent audits, role-based access control (RBAC), and strong encryption protocols.

User Reviews and Case Studies

Real-World Experience Customer reviews and case studies will show you how a fraud blocker works in the field. The resources help you to measure doe the solution which already existing is working fine and with what efficacy before taking a final decision.

Consumer Feedback:

If a fraud blocker has been useful for businesses, user reviews are the best ways to provide feedback. These reviews frequently provide insight into what the tool is and is not good at, e.g., its detection accuracy, usability quality of customer service etc. Multiple reviews will help you to understand better about the fraud blocker.

Commonly Praised Features:

Core features that get specifically spelled out in great detail from 3dcart reviews are the fact that its fraud settings are highly customizable, and its user interface is well laid-out. Seeing which features have consistently ranked high can give you an idea of what capabilities within the fraud blocker will add the most value for your business.

Case Studies—more detail on successful use cases.

Case studies: Smaller case studies illustrating how a business in any industry took advantage of using fraud blocker. This could be, for example, an e-commerce platform claiming a major drop in fraudulent orders or a bank reporting fewer chargebacks. I can understand that these real-life cases will help you in understanding how fraud blocker may add on to your business.

Industry-Specific Insights:

For example, a lot of case studies are used in one particular industry such as e-commerce or finance, or digital services. Real life examples related to specific industries, demonstrate the flexibility of CRIFLendingSolution’s fraud blocker in doing this on a per business vertical basis.

Long-Term Impact:

Case studies can show long-term rewards for leveraging a fraud blocker including enhanced security, improved customer confidence, and superior ROI. Knowing the long-term effects will also help you see how wonderful of an investment that fraud prevention solution actually is.

To sum up, user reviews and case studies represent the actual outputs of a fraud blocker. You may find the following resources useful for selecting a fraud prevention solution for your mobile business.

Conclusion

Selecting the best fraud blocker ph is an essential selection for any on-line service provider that is looking to protect itself versus fraud online. The main considerations will be the detection accuracy, how easy it is to use, ability to customize and scale it, price of models used and integration with existing tools.

Securing your fraud blocker to be compliant with both strictly security and industry compliance standards is key in protecting the data and the trust of customers. Strong customer support, while unreflective of the tool itself, combined with positive user reviews and case studies could greatly illuminate how effective it is).

With the above-mentioned factors, you can zero down on a fraud blocker that not just caters for your requirements today but also scales well enough to serve your business tomorrow and beyond to shield you in the long run from fraud.